Blog

Natural Rate of Interest as New Concern on Jackson Hole Symposium

(International Monetary Fund 2014, Rachel and Smith 2015).

Federal Reserve’s Jackson Hole symposium brought to us one new term, heavily discussed between analysts - ''Natural Rate of Interest". As important milestone for monetary policy, Natural rate or r*(r-star), determines real interest rate which is targeted by policy makers.As an important milestone of monetary policy, natural rate of interest is following use of resources and steady inflation next to FED aimed level. Current predictions shows that as soon as GDP returns to normal, long term potential zero rate will grow in following years.

Doubts are growing since December 2015 when FED increased rate causing discussions how much rates should be grown.

Long Natural Rate is correlated with Long run growth rate through history. As for now 2% of Long run growth rate implies 1% Long-run natural rate.

This one time history volatile conditions are wide spread and FED's macroeconomic aims have been completed. Predictions of r-star in last few decades were precise enough altogether with four quarter growth rate and GDP potential. U.S. Congressional Budget Office (CBO) making projections for GDP potential for 2026.

General models of economic predictions shows that r* is in correlation with households relation between savings and consumption and prediction of growth rate of GDP potential.

Both elements cannot observed directly, which means that r* must be calculated from variables as such as nominal interest rates, inflation, and real GDP growth.

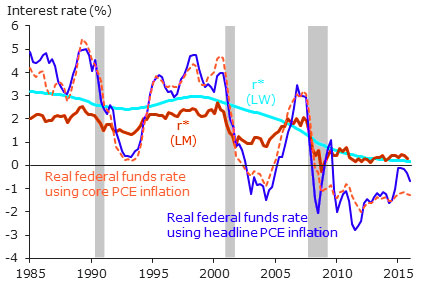

Reasonable differences with these two models of r* predictions are not so much statistically important as fact that they are correlated with declines in real interest rates observed over the same period .

As important input for monetary policy decisions r* predictions, making federal funds rate too high to r* for extended period could contribute that GDP growth goes below potential, and to build up financial imbalances that could make U.S. economy vulnerable to crisis.

Some economist argued because “loose” monetary policy between 2001 and 2006 when federal funds rate stayed below r-star triggered rise of prices of U.S. houses and mortgage debt what at the end caused crisis and recession.

New York FED Executive Bill Duddley showed concerns that central bank maybe closing to rate increase no matter that monetary policy is not simulative at this moment.

As we know lower predictions of r-star partly causing lower potential output growth (y-star) and low growth of GDP is frustrating policymakers which predicted considerable progress on the labor market has made since the crisis-era lows six years ago.

San Francisco FED Executive John Williams, announced that central banks simply don't have enough space to cut interest rates because they are already too low. As we know cutting interest rates is basic weapon of central bank fighting with crisis and recession.

Conclusion

CBO current projections of long-run growth rate for potential GDP are 2% and that could imply r* value of 1% . If we accept those projections as accurate then we could expect that monetary policy will follow rise in r*, and could lead to normalization of FEDs rate.

This post is a contribution by Daniel Quinn from InvestmentTraining.org

Comments