Deals

Proposed Acquisition of Wellman Hunt Graham Ltd and Wellman Defence Limited and Proposed Placing to raise £6.35 million

The Board of Corac is pleased to announce that is has entered into a conditional agreement (the "Acquisition Agreement")to purchase the entire issued share capital of Wellman Hunt Graham Ltd ("Wellman Hunt Graham") and the entire issued share capital of Wellman Defence Limited ("Wellman Defence") for an aggregate consideration of £10.75 million (subject to net asset adjustment), which includes the discharge of outstanding liabilities to Barclays Bank plc (the "Acquisition").

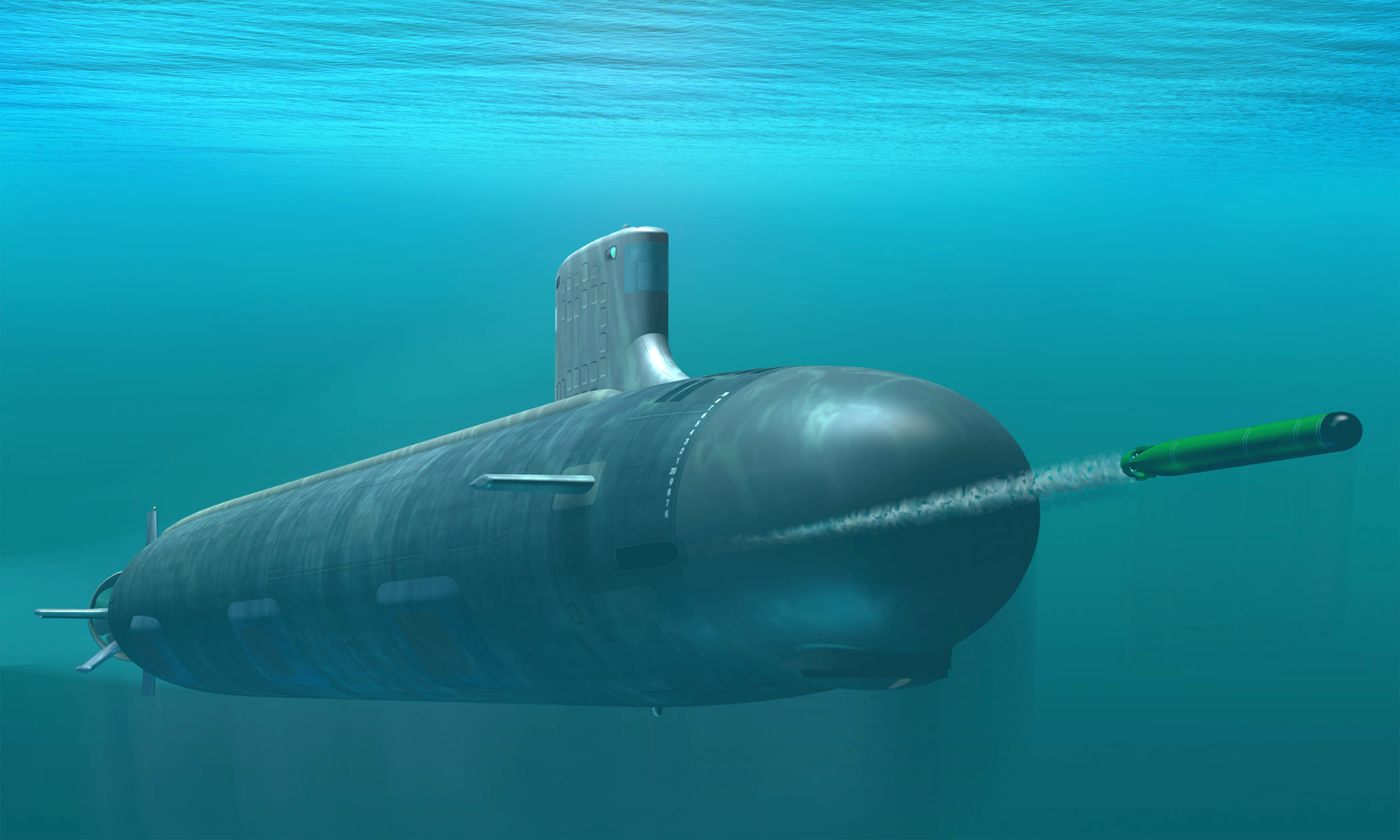

Wellman Defence is a leading global supplier of submarine air purification equipment and clean air ventilation, with proprietary technology and a pipeline of innovations.

Wellman Hunt Graham is a UK based manufacturer and supplier of shell and tube heat exchangers, supplying a number of industries including downstream oil and gas, chemical, energy and food.

The Board of Corac proposes to fund the Acquisition through a combination of its own cash resources and a share placing. The placing of 60,476,191 Placing Shares at 10.5 pence per new share (the "Issue Price") will raise approximately £6.35 million before expenses (the "Placing"). The Placing is conditional, inter alia, on the passing of certain resolutions by Corac's shareholders (the "Resolutions") at a general meeting of the Company and admission of the Placing Shares to AIM ("Admission").

The Company yesterday posted to all shareholders a circular (the "Circular") setting out full details of the Placing and Acquisition and convening a general meeting to be held on 30 March 2012 (the "GM") for the Placing. The Circular will also be made available on the Company's website at www.corac.co.uk

Information on Wellman Defence Limited

Wellman Defence is a leading global supplier of submarine air purification equipment and clean air ventilation, with proprietary technology and a pipeline of innovations. Wellman Defence began trading as CJB (Developments) Limited in 1969.

Wellman Defence supplies combined oxygen generation systems for modern submarines and submarine air purification equipment for both new and existing submarines. It has sold equipment through contractors such as BAE Systems and Babcock and has two 10-year maintenance and service contracts with the Ministry of Defence. Wellman Defence also exports to other national defence forces. In addition to its defence products, Wellman Defence also supplies a range of hydrogen purifiers for industrial use as well as providing engineering design and manufacturing. Recent innovations include the development of combined oxygen generating systems within the submarine atmosphere control system business, Texvent® and smoke removal unit.

Wellman Defence is based in purpose-built premises in Portsmouth and has 54 employees. Wellman Defence reported revenues of £10.4m and EBITDA of £2.4m for the year ended 31 December 2011, and revenues and EBITDA of £9.1m and £1.5m respectively for the year ended 31 December 2010.

Information on Wellman Hunt Graham Ltd.

Wellman Hunt Graham is a UK based manufacturer and supplier of shell and tube heat exchangers, supplying a number of industries including downstream oil and gas, chemical, energy and food. It was initially established as Heat Transfer Limited in 1956 and the present business was formed in 2005 through the merger of Wellman Graham Limited and Hunt Thermal Engineering Limited.

Wellman Hunt Graham predominantly serves the UK market but has a global customer base. Recurring customers include BP, Foster Wheeler, Jacobs Engineering, Shell, Chevron, Saudi Aramco and Uhde. Wellman Hunt Graham also provides bespoke thermal, mechanical and detailed engineer design capability and "one stop shop" design, build and refurbishment services for its clients.

Wellman Hunt Graham operates from a large purpose-built factory in Dukinfield, Manchester, and has 67 employees. Wellman Hunt Graham reported revenues of £9.4m and EBITDA of £0.6m for the year ended 31 December 2011, and revenues and EBITDA of £6.9m and £0.3m respectively for the year ended 31 December 2010.

Reasons for the Acquisition

The Directors believe that Corac's proprietary technology together with its development programme and partnerships represent a strong research and technology platform. The Acquisition will transform Corac from being a research and technology group into a technology-led industrial engineering group with established commercial relationships and a track record of revenue and profit contribution.

In addition, the Directors believe that the Acquisition brings the following strong strategic and financial benefits for the Company:

- Diversifies technology risk and strengthens Corac's IP portfolio - Corac's existing business is in pre-commercial stage and is focused on its core compressor technology. The acquired businesses have proven, proprietary technologies in commercial stage which diversify Corac's exposure to its core technology.

- Introduces sustainable revenues and contribution, reducing Corac's cash burn - Corac's existing business is in pre-commercial stage. The acquired businesses are well established profitable businesses. Their anticipated financial contribution is expected to partially offset Corac's current cash burn.

- Creates an opportunity to leverage Corac's management and resources to develop further the acquired businesses - The Directors believe that through Corac's resources and management focus there is an opportunity to grow and improve profitability in the future.

- Contributes complementary, engineering design capabilities to Corac

- Strengthens Corac's presence in the oil and gas markets - Wellman Hunt Graham has a number of clients in the oil and gas markets which enhances the Group's routes to market for its core technologies.

- Contributes skill sets and management experience gained through developing and commercialising technology within the Wellman Defence business as well as the existing manufacturing, assembly and supply chain management capability within Wellman Hunt Graham to enhance the delivery of Corac's technology to market.

Principal terms of the Acquisition

Pursuant to the Acquisition Agreement, Corac has conditionally agreed to purchase the entire issued share capitals of each of Wellman Hunt Graham and Wellman Defence from InMed Ventures Limited ("InMed"), a company incorporated in Gibraltar, for a cash consideration of £10.75m (subject to a net asset adjustment up to a maximum increase of £0.5m), which includes the discharge of outstanding liabilities to Barclays Bank plc. The obligations of InMed under the Acquisition Agreement are jointly and severally guaranteed by five guarantors (individuals linked with InMed) up to a maximum amount of £7m.

The Acquisition Agreement is conditional, inter alia, on the passing of the Resolutions at the GM and on Admission. It requires that, at completion of the Acquisition, all security over each of Wellman Hunt Graham and Wellman Defence is formally released, both by Barclays Bank plc who currently have registered legal charges over each company's assets, and also in respect of any intra-group collateral guarantee or other security arrangements. If the Placing fails to become unconditional on or before 30 April 2012 and the conditions relating to the Placing under the Acquisition Agreement are not waived (except where the conditions relating to the Placing are not capable of satisfaction as a result of InMed's breach or Corac exercising its rescission rights under the Acquisition Agreement), Corac is required to pay InMed an amount equal to £0.25m in full satisfaction of all liabilities to InMed under the Acquisition Agreement.

The Acquisition Agreement contains a provision for an escrow arrangement, whereby £500,000 of the consideration payable to InMed is held in escrow for a period of up to 12 months following completion of the Acquisition, to deal with net asset, warranty and indemnity claims during this time.

Corac has a contractual right to terminate the Acquisition Agreement prior to Admission in certain circumstances, including for material breach of warranty (where for the purposes of determining what constitutes a "material" breach, "material" is defined as having an effect on the balance sheet or profit before tax of either target entity in excess of £0.5m or £0.25m respectively). If the Company rescinds the Acquisition Agreement prior to Admission, InMed is required to pay to Corac an amount equal to £0.6m in full satisfaction of all liabilities to Corac under the Acquisition Agreement.

Security in favour of Barclays Bank plc

Subject always to the value of the Placing and subsequent Completion, Barclays Bank plc has agreed to provide a new aggregate overdraft facility to the Enlarged Group of £2.5m, in addition to underwriting existing and new performance bonds for each of Wellman Defence and Wellman Hunt Graham. In contemplation of such arrangements, it is proposed that new security will be entered into at Completion by the Enlarged Group in favour of Barclays Bank plc, comprising, inter alia, a cross guarantee and debenture, a guarantee and an assignment over future monies due to the Company.

Principal terms of the Placing

Corac proposes to issue 60,476,191 Placing Shares at the Issue Price, which will raise approximately £5.02m, net of expenses. The net proceeds of the Placing will be used to pay the consideration for the Acquisition.

The Placing is conditional, inter alia, on both the passing of the Resolutions to be proposed at the GM and Admission. It is expected that dealings in the Placing Shares will commence on AIM on 2 April 2012 (or such later date as shall be determined by Cenkos and the Company, being not later than 30 April 2012). If Admission has not so occurred by such later date, application monies will be returned to Placees without interest as soon thereafter as is practicable and in any event by 2 May 2012.

Comments