Top Stories

North American and European Dental Implant Markets Set To Grow

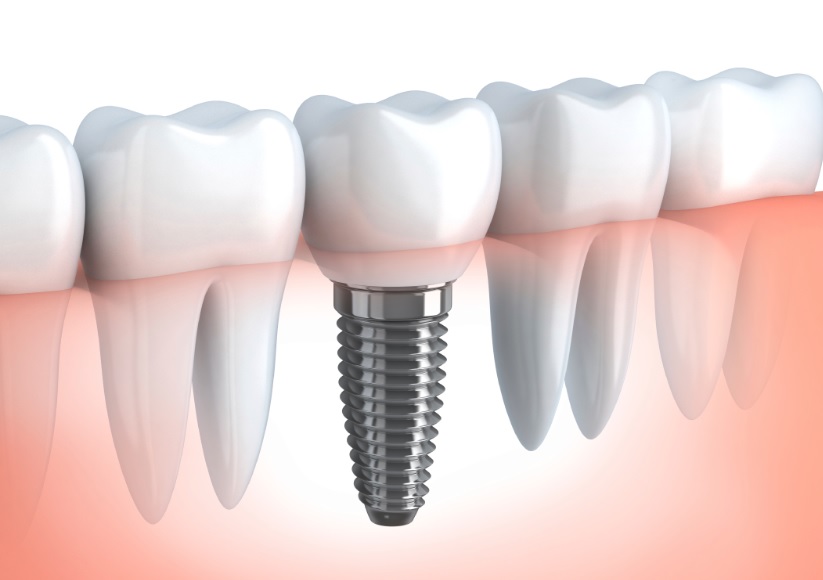

Decision Resources Group finds that the North American and European markets for dental implants will expand through 2022 to reach a combined value of nearly $4.2 billion. While the North American market will continue to experience stronger growth, the European market will remain negatively affected by economic concerns, which will cause the market to decline over the next few years before gradually recovering.Other key findings from Decision Resources Group's coverage of the North American and European dental implant markets:

- Market drivers: The market will be primarily driven by an aging population—because the elderly are more likely to have poor oral health—as well as an increasing number of general practitioners offering dental implant procedures. This trend is particularly strong in Canada, where there is a lower proportion of dental specialists compared to other developed countries.

- Final abutment types: In both North America and Europe, there is growing adoption of custom-milled abutments, which fit better and are more aesthetically appealing. However, there is still strong demand for less expensive prefabricated abutments. In North America, the trend is toward screw-retained abutments because of concerns regarding cement leakage with cement-retained abutments. This is in contrast to Europe, where patients value the superior aesthetics of cement-retained abutments compared to screw-retained abutments.

- Replacement market for final abutments: A replacement market for final abutments is beginning to appear in Europe, where implant dentistry is more established compared to North America. Because final abutments wear out faster than dental implant fixtures, some patients are beginning to require the replacement of the final abutment before the implant fixture.

Comments from Decision Resources Group Analyst Kristina Vidug:

- "Low-cost competitors have become more prevalent in both North America and Europe as economic conditions continue to limit out-of-pocket spending on elective procedures. For example, two of the largest value competitors—Implant Direct Sybron International and HiOssen—have recently entered the Canadian market with great success. However, we'll start to see a shift back in favor of the traditional premium competitors, like Straumann and Nobel Biocare, as the economy strengthens."

Comments from Decision Resources Group Analyst Jack Mohr:

- "The dental implant competitive landscape will be significantly impacted by Zimmer's agreement to acquire Biomet. These companies have traditionally held strong positions in the dental implant market, and this acquisition will place them squarely among leading dental implant competitors Straumann, Nobel Biocare and DENTSPLY Implants."

Comments