Private equity in the energy market

Corporate finance has a huge part to play in the success of the UK energy market not least because bank funding can be difficult to obtain for renewable projects – it is common knowledge that major UK banks have shown a reluctance to be involved in this market. Combined with the fact that there are very exciting profits available, Martineau’s city-facing Corporate Finance team has seen a significant rise in the number of investors looking at this market. Infrastructure funding and private equity are significant contributing factors in launching a project and keeping it in operation.

A number of our clients have been investing in green technology for many years, but it’s only been recently that the popularity of renewables has really taken off. The main attraction currently is solar projects, although the announcement of the Government’s fast track review of feed-in tariffs caused concerns for some, who pulled out of the market. Others remained but we were acting under immense pressure to bring those deals to a financial close. UK investors in venture capital trusts currently receive income tax relief and tax free dividends on their investment and the Government has pledged to keep these levels until April 2012 but it will be interesting to see what happens post April 2012 when we enter a new tax year.

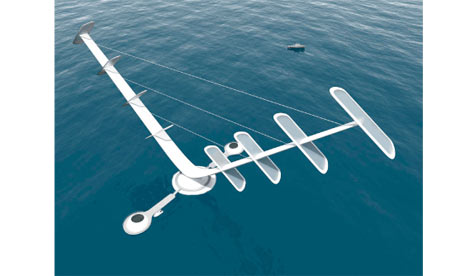

Despite planning difficulties that can often arise, the most favoured renewable technology previously for private investors was wind farms. These are considered to be one of the most mature – and therefore reliable – technologies and Martineau’s industry-leading Energy team has a wealth of experience in advising clients in this area.

It’s our significant expertise in the environmental and technology sectors which enables us to give clients commercial and practical advice. Several of the firm’s current clients can see real opportunities in this market and are now developing funds for renewable projects as a result. We’ve been involved in a significant number of VCT funds in recent years, a number of which are looking to invest in renewable energy projects – a clear indication of where good returns on investment can be expected.

Other areas we’re seeing a growing interest in include hydroelectric power projects and waste-to-energy – the latter being of interest to the more innovative and forward-thinking investors. We’ve also been working for two years on a biomass project which is just coming to completion now. These are all examples of renewable projects, which together can help the UK meet its 2020 renewable energy programme targets – there’s an obvious need for alternative technologies and there is increasing pressure on developers.

The risk-return profile for these projects is generally good. The main risk associated with projects of this nature is gaining accreditation for the site build but using tried and tested technology often negates this risk and projects should see very good returns.

The legal process around these deals can be complex, especially as they’re usually multi-project deals. Generally we’re dealing with funding and commercial structures, including due diligence on commercial contracts. There are often challenges which need to be carefully project managed – that project manager needs to ensure all the threads are pulled together to form the perfect legal framework, working together with lawyers of many different specialisms.

For example, at Martineau, the Corporate Finance team adopts a cross-team strategy, working closely with other lawyers who have in-depth knowledge and expertise in their field, which means clients have all the resources they need under one roof.

We project manage, working closely with the Energy team led by senior partner, Andrew Whitehead – a renowned specialist in his field – who will look at agreements relating to the supply of energy on projects. Martineau’s construction lawyers look at construction contracts and commissioning of the plant; specialist commercial lawyers consider the contracts pertaining to the plant operations when it’s built, while property lawyers deal with landowners and site leases. They ensure that land does belong to sellers, that there are no restrictions in place when that land is sold and investigate access rights and planning permissions. Planning lawyers also deal with objections – which aren’t as prevalent for solar projects as these can be easily screened. Wind farms and hydroelectric power cause more objections due to their scale and sheer size as they’re often in rural areas, which are then threatened by the presence of turbines or power plants, with associated noise and traffic issues. This can make planning a very difficult area indeed. Furthermore, the Localism Bill is expected to make it even harder for projects to pass through planning.

Long term, however, we believe prospects for the sector are very strong. Despite the government sending confusing signals about the importance it places on renewable energy, we have many schemes on our books, funded in a variety of ways and we’re confident we shall see more of these in the future.

Kavita is a partner and head of corporate finance at law firm, Martineau. She specialises in private equity and corporate finance transactions including the establishment of investment funds, public and private fund raising, venture capital and private equity investments, takeover, mergers and reconstructions.

Kavita has secured an impressive portfolio of work from London for Martineau. Her recent work includes venture capital investments in the environmental infrastructure sector including renewables and solar energy.

Kavita sits on both the VCT Forum and VCT Technical Committee of the AIC and is a member of the EIS Association. Kavita can be contacted on 0800 763 1645 or by email at kavita.patel@martineau-uk.com

Comments